Working Capital Definition Simple

adminse

Mar 29, 2025 · 8 min read

Table of Contents

Unlocking Growth: A Simple Definition of Working Capital and its Crucial Role

What is the single most important factor determining a business's short-term health and ability to seize opportunities?

Effective working capital management is the lifeblood of a thriving enterprise, providing the fuel for growth and resilience.

Editor’s Note: This comprehensive guide to working capital has been published today to provide clear, actionable insights into this critical business function.

Why Working Capital Matters

Working capital, in its simplest form, represents the difference between a company's current assets and its current liabilities. It's the readily available cash and near-cash resources a business uses to fund its day-to-day operations. Understanding and effectively managing working capital isn't just an accounting exercise; it's a strategic imperative. A healthy working capital position enables a company to:

- Meet short-term obligations: Pay suppliers, employees, and other creditors on time, avoiding late payment penalties and damaging credit ratings.

- Take advantage of opportunities: Seize unexpected market opportunities, invest in new equipment or inventory, or expand into new markets without financial constraint.

- Weather economic downturns: Navigate periods of reduced sales or increased expenses with greater resilience, avoiding financial distress.

- Enhance profitability: Optimize inventory levels, accelerate collections, and negotiate favorable payment terms with suppliers, leading to improved cash flow and profitability.

- Attract investors: Demonstrate financial stability and efficient operations, making the company a more attractive investment prospect.

Overview of the Article

This article provides a detailed exploration of working capital, moving beyond the simple definition to delve into its key components, management strategies, and the critical implications for business success. Readers will gain a comprehensive understanding of working capital's role, learn how to assess their own working capital position, and discover actionable strategies for optimization.

Research and Effort Behind the Insights

The insights presented in this article are based on extensive research, incorporating data from financial reports, industry analyses, and established accounting principles. The information draws on decades of established financial theory and practice, offering a practical and relevant perspective for businesses of all sizes.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Working Capital Definition | Current Assets - Current Liabilities |

| Current Assets | Cash, accounts receivable, inventory, and other short-term assets. |

| Current Liabilities | Accounts payable, short-term debt, and other obligations due within one year. |

| Importance | Fuels day-to-day operations, enables growth, mitigates financial risk, enhances profitability. |

| Management Strategies | Optimize inventory, accelerate receivables, negotiate favorable payment terms with suppliers. |

Let’s dive deeper into the key aspects of working capital, starting with its foundational components and their practical implications.

Exploring the Key Aspects of Working Capital

-

Understanding Current Assets: These are assets that can be converted into cash within one year. The most significant are:

- Cash: The most liquid asset, representing readily available funds.

- Accounts Receivable: Money owed to the business by customers for goods or services sold on credit. Efficient management of accounts receivable is crucial for optimizing cash flow.

- Inventory: Goods held for sale. Efficient inventory management is vital to avoid tying up capital in unsold goods while ensuring sufficient stock to meet demand.

- Prepaid Expenses: Expenses paid in advance, such as insurance premiums or rent.

-

Analyzing Current Liabilities: These are obligations due within one year. The most important are:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit. Managing accounts payable effectively involves negotiating favorable payment terms and avoiding late payments.

- Short-term Debt: Loans and other financing arrangements due within one year.

- Accrued Expenses: Expenses incurred but not yet paid, such as salaries or utilities.

-

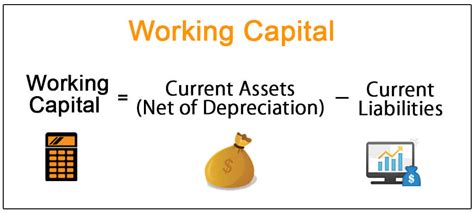

Calculating Working Capital: The simple calculation is: Working Capital = Current Assets - Current Liabilities. A positive working capital balance indicates the company has sufficient current assets to cover its current liabilities. A negative balance suggests potential financial difficulties.

-

Working Capital Ratio: This ratio provides a more insightful measure of a company's short-term liquidity. It's calculated as: Working Capital Ratio = Current Assets / Current Liabilities. A ratio above 1 suggests a healthy liquidity position, while a ratio below 1 indicates potential short-term liquidity concerns.

-

Interpreting Working Capital: The interpretation of working capital figures requires careful consideration of the specific industry, business model, and overall financial health of the company. Comparisons to industry benchmarks and historical trends can provide valuable insights.

-

Managing Working Capital Effectively: Effective working capital management requires a multi-faceted approach, encompassing:

- Inventory Management: Implementing just-in-time inventory systems, optimizing stock levels, and minimizing waste.

- Accounts Receivable Management: Establishing clear credit policies, monitoring outstanding receivables closely, and pursuing prompt collection of overdue payments.

- Accounts Payable Management: Negotiating favorable payment terms with suppliers, taking advantage of early payment discounts where available, and ensuring timely payments to maintain good supplier relationships.

- Cash Flow Forecasting: Developing accurate cash flow projections to anticipate potential shortfalls and plan accordingly.

- Debt Management: Strategically managing short-term debt to ensure manageable repayment schedules and minimize interest expenses.

Closing Insights

Effective working capital management is not a static process; it requires ongoing monitoring, analysis, and adaptation to changing market conditions and business needs. By understanding the components of working capital, assessing its current status, and implementing appropriate management strategies, businesses can significantly enhance their financial health, improve operational efficiency, and create a stronger foundation for growth and long-term success. Ignoring working capital management can lead to cash flow problems, missed opportunities, and ultimately, business failure. Proactive management, however, can unlock significant potential for increased profitability and sustained growth.

Exploring the Connection Between Inventory Management and Working Capital

Efficient inventory management plays a crucial role in optimizing working capital. Holding excessive inventory ties up significant capital that could be used for other productive purposes. Conversely, insufficient inventory can lead to lost sales and dissatisfied customers. The ideal inventory level is a delicate balance between meeting customer demand and minimizing capital tied up in stock. Techniques such as Just-In-Time (JIT) inventory management help to minimize storage costs and reduce the risk of obsolescence. Effective forecasting, accurate demand planning, and robust inventory tracking systems are essential tools for optimizing inventory levels and improving working capital management. Failing to manage inventory effectively can lead to significant working capital strain, impacting the company's ability to meet its short-term obligations and hindering its growth potential.

Further Analysis of Inventory Management

| Inventory Management Strategy | Advantages | Disadvantages |

|---|---|---|

| Just-in-Time (JIT) | Reduced storage costs, minimized waste, improved efficiency | Requires precise demand forecasting, vulnerable to supply chain disruptions |

| Economic Order Quantity (EOQ) | Optimizes order sizes to minimize total inventory costs | Assumes constant demand, may not account for seasonal fluctuations |

| ABC Analysis | Prioritizes inventory management based on value and importance | Requires detailed inventory data |

| Vendor Managed Inventory (VMI) | Shifts inventory management responsibility to the supplier | Requires strong supplier relationships and trust |

FAQ Section

-

Q: What is the difference between working capital and net working capital? A: The terms are often used interchangeably. However, some sources define net working capital as the difference between current assets and current liabilities, while working capital encompasses a broader range of concepts, including the management strategies and their impact on a business's financial health.

-

Q: How can I improve my company's working capital? A: Focus on optimizing inventory, accelerating receivables collection, negotiating favorable payment terms with suppliers, and carefully managing short-term debt.

-

Q: What is a healthy working capital ratio? A: There's no single "perfect" ratio. A ratio above 1 generally indicates a healthy liquidity position, but the ideal ratio varies depending on the industry, business model, and company-specific factors.

-

Q: What happens if a company has negative working capital? A: It indicates the company's current liabilities exceed its current assets, potentially signaling financial distress and difficulty meeting short-term obligations.

-

Q: How often should I review my working capital? A: Regularly, ideally monthly, to track trends, identify potential issues, and adjust strategies as needed.

-

Q: Can working capital be used to fund long-term investments? A: While working capital primarily supports short-term operations, it can sometimes be strategically used to partially fund long-term projects, but this requires careful planning and consideration of the overall financial implications.

Practical Tips

- Implement robust inventory management systems: Track inventory levels closely, forecast demand accurately, and use just-in-time inventory strategies where appropriate.

- Develop a strict accounts receivable policy: Establish clear credit terms, monitor outstanding invoices diligently, and pursue prompt payment from customers.

- Negotiate favorable payment terms with suppliers: Explore early payment discounts and extend payment terms where feasible.

- Forecast cash flow accurately: Develop detailed cash flow projections to anticipate potential shortfalls and make timely adjustments.

- Maintain a healthy level of cash reserves: Hold sufficient cash on hand to cover unexpected expenses and operational needs.

- Explore financing options strategically: Consider short-term financing solutions like lines of credit to address temporary cash flow gaps.

- Regularly review and analyze your working capital: Track key metrics like the working capital ratio and identify areas for improvement.

- Invest in technology to automate processes: Leverage software solutions to streamline accounts receivable and payable management, improve inventory tracking, and enhance cash flow forecasting.

Final Conclusion

Understanding and managing working capital effectively is a cornerstone of successful business operations. It's not just about numbers; it's about ensuring a business has the financial resources to operate smoothly, seize opportunities, and withstand economic uncertainties. By proactively monitoring working capital, implementing efficient management strategies, and adapting to changing circumstances, businesses can build a strong financial foundation, fostering sustainable growth and long-term success. The insights and practical tips provided in this article serve as a valuable resource for businesses of all sizes, enabling them to unlock the full potential of their working capital and achieve their financial goals.

Latest Posts

Latest Posts

-

What Minimum Due Amount Credit Card

Mar 31, 2025

-

Minimum Payment Credit Card

Mar 31, 2025

-

Can You Pay Off A Credit Card With Minimum Payment

Mar 31, 2025

-

What Does Minimum Payment In Credit Card Mean

Mar 31, 2025

-

What Happens If I Only Pay The Minimum Payment On My Credit Card

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Working Capital Definition Simple . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.