What Is The Grace Period For Chase Credit Card

adminse

Mar 29, 2025 · 8 min read

Table of Contents

Decoding the Chase Credit Card Grace Period: Discoveries and Insights

What truly defines the grace period for a Chase credit card, and how can understanding it maximize financial benefits?

Mastering your Chase credit card's grace period is key to avoiding unnecessary interest charges and optimizing your credit health.

Editor’s Note: This comprehensive guide to Chase credit card grace periods was published today, offering the latest insights and information.

Why Understanding Your Chase Credit Card Grace Period Matters

Navigating the complexities of credit cards requires a thorough understanding of various terms and conditions. The grace period, specifically, is a critical element that significantly impacts your overall credit card management and financial well-being. A clear grasp of this period allows cardholders to avoid accumulating interest charges, optimize their finances, and maintain a healthy credit score. This knowledge is particularly relevant for Chase credit card holders, given the variety of cards offered and the potential differences in their terms. Failing to understand the grace period can lead to unforeseen interest payments, impacting your budget and potentially harming your creditworthiness. This article will equip you with the necessary knowledge to effectively manage your Chase credit card and leverage the grace period to your advantage.

Overview of This Article

This article delves into the nuances of Chase credit card grace periods, exploring what constitutes a grace period, the factors affecting its length, how to calculate it accurately, and strategies to maximize its benefits. We will also examine the potential consequences of missing payments during the grace period and offer practical tips for effective credit card management. Readers will gain a comprehensive understanding of how the grace period works and how to leverage it to improve their financial standing.

Research and Effort Behind the Insights

This article is based on extensive research, drawing from Chase's official website, terms and conditions documents for various Chase credit cards, consumer financial protection resources, and insights from financial experts. We have meticulously analyzed information to ensure accuracy and provide readers with reliable and up-to-date information.

Key Takeaways

| Key Aspect | Insight |

|---|---|

| Grace Period Definition | The period between the end of your billing cycle and the due date, where no interest accrues on purchases. |

| Grace Period Length | Typically 21 days, but can vary slightly depending on the card and payment processing times. |

| Factors Affecting Grace Period | Payment timing, card type, and Chase's internal processing schedules. |

| Calculating Grace Period | Subtract the billing cycle end date from the payment due date. |

| Consequences of Missing Payment | Late payment fees, increased interest charges, and potential negative impact on credit score. |

| Maximizing Grace Period | Pay your balance in full before the due date to avoid interest. |

Smooth Transition to Core Discussion

Let's now delve into the core aspects of understanding and utilizing the grace period offered on your Chase credit card. We will begin by defining the grace period and then explore the factors that influence its duration.

Exploring the Key Aspects of Chase Credit Card Grace Periods

-

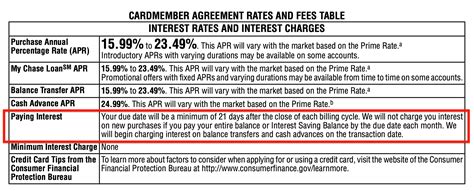

Defining the Grace Period: The grace period is the timeframe between the close of your Chase credit card billing cycle and the payment due date. During this period, no interest charges accrue on new purchases made during the previous billing cycle. This crucial period allows cardholders to pay their balance in full and avoid incurring interest. It's important to note that this grace period only applies to purchases; it does not usually extend to balance transfers, cash advances, or other fees.

-

Factors Affecting Grace Period Length: While a 21-day grace period is common for Chase credit cards, the exact duration can subtly vary. This variation stems from several factors: the specific terms and conditions of your individual Chase credit card, the precise timing of your payment processing by Chase, and occasional variations in the calendar. It's crucial to always refer to your monthly statement for the precise due date to ensure you accurately determine your grace period.

-

Calculating Your Grace Period: Determining your grace period is straightforward. Locate the "Statement Closing Date" and the "Payment Due Date" on your monthly statement. Simply subtract the statement closing date from the payment due date. The result is the length of your grace period in days.

-

Consequences of Missing the Payment Due Date: Failing to pay your balance in full before the payment due date eliminates your grace period's benefits. This means that interest charges will be applied retrospectively to all purchases made during the previous billing cycle, from the statement closing date onwards. Furthermore, you will likely incur late payment fees, and consistent late payments will negatively affect your credit score, making it harder to obtain loans or favorable credit terms in the future.

-

Maximizing the Benefits of Your Grace Period: The most effective way to benefit from your Chase credit card's grace period is to pay your balance in full before the payment due date. This prevents the accrual of any interest charges. By diligently monitoring your spending and ensuring timely payments, you can effectively manage your credit card debt and avoid unnecessary financial burdens.

-

Understanding the Impact of Balance Transfers and Cash Advances: Remember that balance transfers and cash advances typically do not qualify for the grace period. Interest on these transactions begins accruing immediately. It's vital to consider these costs when using these card features.

Exploring the Connection Between Payment Timing and the Chase Grace Period

The relationship between the timing of your payment and the grace period is paramount. Making your payment before the due date is the most crucial aspect of maximizing the grace period. Even a single day's delay can negate the grace period's benefits, leading to interest charges. Chase's systems process payments, and a slight delay in processing could mean your payment doesn't register within the grace period, regardless of when you initiated the payment. Therefore, proactive and timely payments are essential. For example, paying a few days early provides a buffer against potential processing delays and ensures you remain within the grace period.

Further Analysis of Payment Methods and their Impact on Grace Periods

Different payment methods can impact the timing of your payment's registration with Chase. While online payments are generally processed quickly, mail-in payments carry a higher risk of delays due to postal transit times. Therefore, online payment methods are generally recommended for ensuring timely payment and maximizing the grace period. A detailed analysis of processing times for different payment methods could be compiled into a table, comparing online banking, mobile app payments, and mailed checks. This table would highlight the average processing time for each method, emphasizing the benefits of faster electronic methods to secure the grace period.

FAQ Section

-

Q: What happens if I miss my payment due date? A: You will lose the grace period benefits, accruing interest on purchases from your statement closing date. Late payment fees may also apply, and your credit score could be negatively impacted.

-

Q: Does the grace period apply to all Chase credit cards? A: Yes, generally, but the specific length might vary slightly depending on the terms of your individual card agreement. Always refer to your statement for precise details.

-

Q: How can I check my payment due date? A: Your payment due date is clearly stated on your monthly statement, usually prominently displayed. You can also find it through online banking or the Chase mobile app.

-

Q: What if my payment is processed on the due date? A: While aiming to pay before the due date is safest, payment on the due date might still fall within the grace period, depending on Chase's processing time. However, this is not guaranteed, and it's best to aim for earlier payment.

-

Q: Does the grace period apply to balance transfers? A: No, interest typically begins accruing immediately on balance transfers.

-

Q: Can I extend my grace period? A: No, the grace period is a fixed timeframe defined by your card agreement.

Practical Tips for Maximizing Your Chase Credit Card Grace Period

- Set up automatic payments: Schedule automatic payments to ensure on-time payments and avoid late fees.

- Use online banking or the mobile app: These methods offer faster payment processing than mailing a check.

- Monitor your spending: Track your spending to stay within your budget and avoid exceeding your credit limit.

- Pay your balance in full before the due date: This is the most critical step to fully utilize the grace period.

- Read your statement carefully: Pay close attention to the statement closing date and payment due date to accurately calculate your grace period.

- Contact Chase if you have questions: If you have any concerns about your grace period or payment, reach out to Chase customer service for clarification.

- Consider setting up payment reminders: Utilize calendar reminders or mobile app notifications to stay informed of upcoming due dates.

- Review your credit card agreement: Familiarize yourself with the terms and conditions of your specific Chase credit card to fully understand the details of your grace period.

Final Conclusion

Understanding and effectively utilizing the grace period on your Chase credit card is crucial for responsible credit card management and avoiding unnecessary interest charges. By paying attention to payment deadlines, utilizing efficient payment methods, and actively monitoring your spending, you can fully maximize the benefits of this valuable feature. Proactive credit management, built upon a solid understanding of the grace period, empowers you to maintain a healthy financial standing and avoid potential pitfalls associated with late payments. Remember, responsible credit card usage contributes significantly to a strong credit score – a cornerstone of long-term financial well-being.

Latest Posts

Latest Posts

-

Target Method Of Payment

Apr 02, 2025

-

Perkins Loans

Apr 02, 2025

-

Perkins Loan Definition

Apr 02, 2025

-

What Is The Minimum To Pay On A Credit Card

Apr 02, 2025

-

Why Do Credit Cards Have A Minimum Payment

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Is The Grace Period For Chase Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.