Working Capital Definition Class 9

adminse

Mar 29, 2025 · 8 min read

Table of Contents

Understanding Working Capital: A Class 9 Perspective

What exactly is working capital, and why is it so crucial for a business's survival?

Working capital is the lifeblood of any business, ensuring its smooth operation and future growth.

Editor’s Note: This comprehensive guide to working capital has been published today to provide Class 9 students with a clear and concise understanding of this vital business concept.

Why Working Capital Matters

Working capital is a fundamental concept in finance that directly impacts a business's ability to operate efficiently and sustainably. For a Class 9 student, understanding working capital translates to grasping the core mechanism that allows businesses to buy inventory, pay employees, and meet daily operational expenses. It's the difference between a thriving enterprise and one struggling to stay afloat. Ignoring working capital management can lead to cash flow problems, hindering growth and potentially causing bankruptcy. A robust understanding of this concept is crucial, not just for future business leaders, but for anyone interested in the economic engine driving our world. It lays the foundation for understanding broader financial concepts like profitability, liquidity, and solvency.

Overview of the Article

This article will explore the core definition of working capital, detailing its components and calculation. We will delve into the importance of maintaining healthy working capital levels, examining the implications of both insufficient and excessive working capital. Practical examples and scenarios will be used to illustrate the concepts, making them easily digestible for a Class 9 audience. We'll also address common misconceptions and explore how efficient working capital management contributes to a business's overall success. Finally, we'll provide a concise summary of key takeaways.

Research and Effort Behind the Insights

This article is based on established financial principles and draws on widely accepted accounting practices. The information presented is suitable for a Class 9 understanding, avoiding complex mathematical models while maintaining accuracy and clarity. Examples used are relatable and drawn from everyday business scenarios to enhance comprehension.

Key Takeaways

| Key Concept | Description |

|---|---|

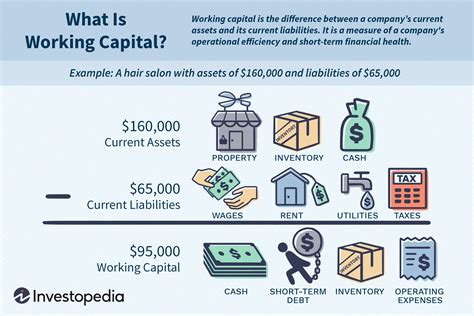

| Working Capital | The difference between current assets and current liabilities. |

| Current Assets | Assets that can be converted into cash within one year (e.g., cash, accounts receivable, inventory). |

| Current Liabilities | Obligations due within one year (e.g., accounts payable, salaries payable, short-term loans). |

| Importance of WC | Essential for day-to-day operations, purchasing inventory, paying expenses, and ensuring smooth business function. |

| Optimal WC Level | Varies depending on industry, business model, and growth strategy; neither too high nor too low is ideal. |

Smooth Transition to Core Discussion

Now, let's delve deeper into the specifics of working capital, exploring its components and the critical role it plays in the financial health of any business, large or small.

Exploring the Key Aspects of Working Capital

-

Defining Working Capital: At its simplest, working capital is calculated as: Working Capital = Current Assets – Current Liabilities. Current assets are short-term assets readily convertible into cash, while current liabilities are short-term debts due within one year.

-

Components of Current Assets: This includes:

- Cash: The most liquid asset, representing readily available funds.

- Accounts Receivable: Money owed to the business by customers for goods or services sold on credit.

- Inventory: Goods held for sale in the normal course of business. This can include raw materials, work-in-progress, and finished goods.

- Prepaid Expenses: Expenses paid in advance, such as rent or insurance.

-

Components of Current Liabilities: This encompasses:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Salaries Payable: Wages owed to employees.

- Short-Term Loans: Loans due within one year.

- Taxes Payable: Taxes owed to the government.

-

Interpreting Working Capital: A positive working capital figure indicates that a business has enough short-term assets to cover its short-term liabilities. A negative working capital figure, however, suggests the business might struggle to meet its immediate obligations. This doesn't automatically mean financial trouble, but it warrants careful examination.

-

Managing Working Capital: Effective working capital management involves strategically managing current assets and liabilities to optimize cash flow and profitability. This might involve techniques like improving inventory management, negotiating favorable payment terms with suppliers, and speeding up collections from customers.

Closing Insights

Understanding working capital is fundamental to comprehending business finance. Maintaining a healthy working capital balance is crucial for ensuring a company's operational efficiency and long-term sustainability. A positive working capital figure provides a buffer against unexpected expenses and ensures the business can meet its short-term obligations. However, excessively high working capital might indicate inefficient use of resources, potentially impacting profitability. Therefore, striking a balance is key to successful business management. The principles discussed here are applicable across various industries and business sizes, forming a solid base for further learning in finance and accounting.

Exploring the Connection Between Inventory Management and Working Capital

Inventory management is intrinsically linked to working capital. Holding excessive inventory ties up significant capital, reducing working capital and potentially impacting profitability. Conversely, insufficient inventory can lead to lost sales and dissatisfied customers. Effective inventory management strategies, such as Just-in-Time (JIT) inventory systems, aim to minimize inventory holding costs while ensuring sufficient stock to meet demand. This careful balancing act directly influences a company's working capital position. For instance, a retail store holding excessive winter coats in the summer will have a lower working capital than a store that successfully sold its inventory before the season ended. Similarly, a manufacturing company that efficiently manages its raw materials and finished goods will have a higher working capital available for other operational needs.

Further Analysis of Inventory Management

| Inventory Management Strategy | Impact on Working Capital | Advantages | Disadvantages |

|---|---|---|---|

| Just-in-Time (JIT) | Improves working capital | Reduces storage costs, minimizes waste | Requires precise demand forecasting, vulnerable to supply disruptions |

| Economic Order Quantity (EOQ) | Optimizes working capital | Balances ordering costs and holding costs | Assumes constant demand and stable prices |

| First-In, First-Out (FIFO) | Relatively neutral impact | Ensures fresh inventory, accurate cost of goods sold | Can lead to higher inventory holding costs |

| Last-In, First-Out (LIFO) | Relatively neutral impact | Matches current costs with current revenues | Can distort profits and tax liabilities |

FAQ Section

-

Q: What happens if a business has negative working capital? A: Negative working capital doesn't automatically signal failure. However, it suggests the business might struggle to meet short-term debts. It often indicates a need for improved cash flow management and potentially external financing.

-

Q: Is high working capital always good? A: No. While sufficient working capital is essential, excessively high levels might indicate inefficient use of resources. Excess cash could be invested more profitably elsewhere.

-

Q: How can a small business improve its working capital? A: Small businesses can improve working capital by negotiating better payment terms with suppliers, speeding up collections from customers, optimizing inventory levels, and exploring financing options.

-

Q: What is the difference between working capital and net working capital? A: The terms are often used interchangeably. However, some sources distinguish between working capital (current assets minus current liabilities) and net working capital, which may include adjustments for specific items.

-

Q: How does working capital relate to profitability? A: Efficient working capital management contributes to improved profitability by reducing financing costs, optimizing inventory levels, and minimizing losses from obsolete or damaged inventory.

-

Q: Can a business survive with zero working capital? A: It’s highly improbable for a business to survive long-term with zero working capital. A certain level of working capital is crucial for meeting day-to-day operational expenses.

Practical Tips

- Implement robust inventory management: Regularly review inventory levels to minimize storage costs and avoid obsolete stock.

- Negotiate favorable payment terms: Seek extended payment terms from suppliers to improve cash flow.

- Speed up accounts receivable collection: Follow up promptly on outstanding invoices to reduce the time it takes to receive payments.

- Improve forecasting: Develop accurate sales forecasts to anticipate demand and optimize inventory levels.

- Explore financing options: Consider short-term financing options if needed to cover unexpected expenses or seasonal fluctuations.

- Track key metrics: Monitor key working capital ratios regularly to identify potential issues early on.

- Automate processes: Use accounting software and automation tools to streamline financial processes and improve efficiency.

- Regularly review financial statements: Analyze financial statements to identify trends and make informed decisions about working capital management.

Final Conclusion

Working capital is a cornerstone of financial health for businesses of all sizes. Understanding its components, calculation, and effective management is crucial for any business aiming for sustainable growth and profitability. By applying the insights and practical tips discussed in this article, students can gain a solid foundation in this important financial concept, equipping them with the knowledge to make informed decisions in their future endeavors. The importance of balancing sufficient working capital with efficient resource utilization cannot be overstated. Continual monitoring, analysis, and adaptation are essential for navigating the dynamic landscape of business finance.

Latest Posts

Latest Posts

-

What Minimum Due Amount Credit Card

Mar 31, 2025

-

Minimum Payment Credit Card

Mar 31, 2025

-

Can You Pay Off A Credit Card With Minimum Payment

Mar 31, 2025

-

What Does Minimum Payment In Credit Card Mean

Mar 31, 2025

-

What Happens If I Only Pay The Minimum Payment On My Credit Card

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Working Capital Definition Class 9 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.