What Is The Grace Period For Federal Student Loans After Graduation

adminse

Mar 29, 2025 · 7 min read

Table of Contents

Decoding the Grace Period: Your Guide to Federal Student Loan Post-Graduation

What happens to my federal student loans the moment I graduate?

Understanding your federal student loan grace period is crucial for avoiding late payments and damaging your credit score.

Editor’s Note: This comprehensive guide to federal student loan grace periods was published today, providing the most up-to-date information available.

Why Understanding Your Grace Period Matters

The transition from student to working professional is already stressful. Adding the immediate pressure of student loan repayment can feel overwhelming. Knowing precisely how the grace period functions is paramount. It's not merely a period of leniency; it's a critical buffer designed to allow graduates time to secure employment and adjust to financial independence before repayment begins. Failure to understand its intricacies can lead to missed payments, late fees, and potentially severe damage to your credit history. This impacts not only your immediate financial health but also your ability to secure future loans, mortgages, and even employment opportunities. This article explores all aspects of the grace period, empowering you to navigate this phase successfully.

Overview of This Article

This article provides a comprehensive examination of the federal student loan grace period. We will explore its duration, eligibility requirements, different types of loans and their associated grace periods, what happens if you miss payments during or after the grace period, and practical steps to prepare for repayment. Readers will gain valuable insights to confidently manage their student loan debt and plan their financial future.

Research and Effort Behind the Insights

The information presented here is based on extensive research of official government websites, including the Department of Education's Federal Student Aid website, and legal interpretations of relevant legislation. We've analyzed various scenarios to provide clear and accurate guidance on the nuances of federal student loan grace periods.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Grace Period Duration | Typically 6 months for most federal student loans, but exceptions exist. |

| Eligibility Requirements | Graduation or leaving school before completing your program. |

| Loan Types & Grace Periods | Different loan types (e.g., Subsidized, Unsubsidized, PLUS) may have variations in grace period application. |

| Consequences of Missed Payments | Late fees, negative credit reporting, potential loan default. |

| Post-Grace Period Actions | Develop a repayment plan, explore income-driven repayment options. |

Smooth Transition to Core Discussion

Let’s delve into the specifics of the federal student loan grace period, beginning with its fundamental aspects and practical implications.

Exploring the Key Aspects of the Grace Period

-

Duration of the Grace Period: For most federal student loans (Subsidized and Unsubsidized Stafford Loans, and Federal Consolidation Loans), the standard grace period is six months. This six-month period begins the day after you cease at least half-time enrollment.

-

Eligibility for a Grace Period: To be eligible, you must have been enrolled at least half-time for a certain period of time, then leave school without completing your educational program. Simply dropping below half-time enrollment doesn't trigger the grace period. It starts when you officially leave school.

-

Loans with Different Grace Periods: Federal PLUS Loans (Parent PLUS Loans and Graduate PLUS Loans) do not have a grace period. Repayment generally begins immediately after the loan is disbursed. Some loan consolidation programs may also have varying grace periods, so consulting your loan servicer is vital.

-

In-School Deferment: Before the grace period even begins, it's important to understand in-school deferment. While enrolled at least half-time, federal student loans are generally deferred, meaning payments are temporarily suspended, and interest may or may not accrue depending on the loan type (Subsidized loans typically do not accrue interest during in-school deferment).

-

Forbearance: If you face financial hardship after the grace period ends, you can consider requesting a forbearance. This temporarily suspends or reduces payments, but interest will typically accrue.

Exploring the Connection Between Loan Type and Grace Period Eligibility

The type of federal student loan significantly impacts grace period applicability. Subsidized Stafford Loans differ from Unsubsidized Stafford Loans in several aspects, including the handling of interest during the grace period.

-

Subsidized Stafford Loans: The government pays the interest during the grace period (and in-school deferment). This means that you don't have to worry about accumulated interest increasing your debt burden during this time.

-

Unsubsidized Stafford Loans: Interest continues to accrue during the grace period for unsubsidized loans. While you don't have to make payments, the interest is capitalized, meaning it's added to your principal loan balance, increasing the overall amount you owe. This capitalization effect can significantly impact the total amount repaid over the loan's lifespan.

-

Federal PLUS Loans: As mentioned earlier, PLUS loans don't have a grace period. Repayment begins immediately upon disbursement. This lack of a grace period necessitates careful financial planning before taking out these loans.

Further Analysis of the Consequences of Missed Payments

Missing payments during or after the grace period can have serious repercussions. The implications go far beyond a simple late fee.

| Consequence | Description |

|---|---|

| Late Fees | Federal student loan servicers assess late fees for missed payments, adding to your overall debt. |

| Negative Credit Reporting | Missed payments are reported to credit bureaus, negatively impacting your credit score, potentially making it harder to secure loans or credit in the future. |

| Loan Default | Repeated missed payments can eventually lead to loan default, triggering significant penalties, wage garnishment, and tax refund offset. |

| Impact on Future Borrowing | A poor credit history directly impacts your ability to secure future loans for mortgages, auto purchases, or even credit cards. |

Frequently Asked Questions (FAQ)

-

What happens if I don't start making payments after the grace period ends? You will begin to accrue late fees and negative marks on your credit report, eventually leading to default.

-

Can I extend my grace period? Generally, no. Extensions are rarely granted and are only available under very specific circumstances, such as documented severe hardship.

-

What if I go back to school after my grace period? You might be able to defer your loans again during your return to school, temporarily suspending payments. Contact your loan servicer to confirm eligibility.

-

How can I find my loan servicer? The National Student Loan Data System (NSLDS) is a centralized database that can help you locate your loan servicer.

-

What repayment plans are available after the grace period? Several options exist, including standard repayment, extended repayment, graduated repayment, and income-driven repayment (IDR) plans.

-

What are income-driven repayment plans? IDR plans calculate your monthly payment based on your income and family size, potentially making payments more manageable.

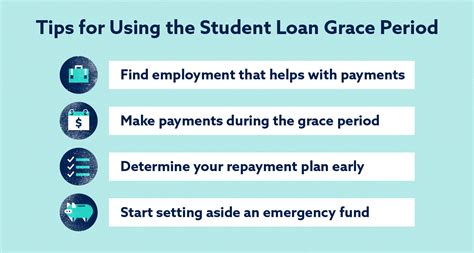

Practical Tips for Managing Your Student Loans

-

Understand Your Loan Terms: Carefully review your loan documents to understand your loan type, interest rate, and repayment schedule.

-

Create a Budget: Develop a realistic budget to determine how much you can comfortably afford to repay each month.

-

Explore Repayment Options: Research different repayment plans to find the one that best suits your financial situation.

-

Automate Payments: Set up automatic payments to avoid late fees and ensure consistent repayment.

-

Communicate with Your Servicer: If you anticipate difficulty making payments, contact your loan servicer immediately to discuss possible solutions, such as forbearance or deferment.

-

Monitor Your Credit Report: Regularly review your credit report to identify any errors or inaccuracies related to your student loans.

-

Consider Refinancing (with caution): Refinancing may lower your interest rate, but carefully weigh the pros and cons before making a decision. Consider whether refinancing private loans is advantageous over federal loans and their associated benefits.

-

Seek Professional Financial Advice: Consult a financial advisor to develop a comprehensive student loan repayment strategy.

Final Conclusion

The federal student loan grace period is a crucial yet often misunderstood aspect of student loan repayment. Understanding its duration, eligibility requirements, and the consequences of missed payments is vital for responsible debt management and long-term financial health. By proactively planning, exploring available repayment options, and maintaining open communication with your loan servicer, graduates can navigate this transition effectively and build a secure financial future. Don't let the grace period pass without a clear understanding of your responsibilities. Take the necessary steps to ensure you are well-prepared for the repayment phase, safeguarding your credit score and long-term financial well-being. The information provided here serves as a guide, but consulting with your loan servicer and a financial professional is always recommended for personalized advice.

Latest Posts

Latest Posts

-

Minimum Target Meaning

Apr 02, 2025

-

Payment For Target

Apr 02, 2025

-

Target Method Of Payment

Apr 02, 2025

-

Perkins Loans

Apr 02, 2025

-

Perkins Loan Definition

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Is The Grace Period For Federal Student Loans After Graduation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.