What Is A Grace Period On A Credit Card Quizlet

adminse

Mar 29, 2025 · 8 min read

Table of Contents

Understanding Grace Periods on Credit Cards: A Comprehensive Guide

What truly defines a credit card grace period, and how does it impact your finances?

Mastering the grace period is key to responsible credit card management and avoiding unnecessary interest charges.

Editor’s Note: This comprehensive guide to credit card grace periods was published today, providing up-to-date information for responsible credit card management.

Why Understanding Grace Periods Matters

Navigating the world of credit cards requires a solid grasp of their mechanics. Among the most crucial aspects is understanding the grace period. This seemingly simple concept significantly impacts your ability to manage credit responsibly and avoid accruing substantial interest charges. A thorough understanding of grace periods allows for proactive financial planning, preventing unexpected debt and fostering better credit health. This knowledge empowers consumers to make informed decisions, potentially saving them considerable amounts of money over time. The impact extends beyond personal finance; a strong understanding of grace periods informs responsible consumer behavior within the broader economic landscape.

Overview of this Article

This article delves into the intricacies of credit card grace periods. We'll explore its definition, how it works, factors that affect its length, the consequences of missing payments during the grace period, and how to maximize its benefits. Readers will gain actionable insights to optimize their credit card usage and avoid unnecessary interest accumulation. We'll also examine common misconceptions and address frequently asked questions to ensure a comprehensive understanding.

Research and Effort Behind the Insights

The information presented here is based on extensive research of credit card agreements from major issuers, analysis of consumer finance regulations, and insights from reputable financial experts. The goal is to provide accurate and reliable information to empower informed decision-making.

Key Takeaways

| Key Concept | Description |

|---|---|

| Grace Period Definition | The time between the end of your billing cycle and the due date for your payment, during which you can avoid interest charges on purchases. |

| Grace Period Length | Typically 21-25 days, but can vary depending on the issuer and your account. |

| Impact of Late Payments | Missing payments during the grace period leads to interest charges on purchases, impacting your credit score. |

| Importance of Payment in Full | Paying your balance in full before the due date is crucial to utilize the grace period effectively. |

| Cash Advance Grace Period | Cash advances typically do not have a grace period, meaning interest accrues immediately. |

| Balance Transfers and Grace Periods | Balance transfers may or may not have a grace period, depending on the terms of the offer. |

Smooth Transition to Core Discussion

Let's now delve into the specifics of credit card grace periods, examining its core components and practical applications.

Exploring the Key Aspects of Credit Card Grace Periods

-

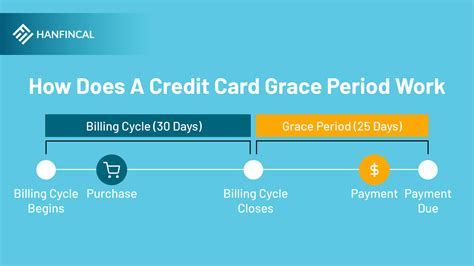

Defining the Grace Period: A credit card grace period is the interest-free period between the end of your billing cycle and the due date of your payment. During this period, you can avoid paying interest on new purchases made during the previous billing cycle, provided you pay your statement balance in full by the due date.

-

How the Grace Period Works: Your credit card issuer tracks your purchases throughout the billing cycle. At the end of the cycle, a statement is generated, outlining your transactions, payments, and the total balance. The grace period begins the day after your billing cycle ends and concludes on the due date printed on your statement. Only purchases made during the preceding billing cycle are eligible for the grace period.

-

Factors Affecting Grace Period Length: The length of the grace period isn't standardized; it varies between credit card issuers and may even vary depending on your specific account. Typically, it ranges from 21 to 25 days. However, certain actions, such as carrying a balance from a previous month, may affect your grace period for the current month.

-

Consequences of Missing Payments: Failure to pay your statement balance in full by the due date eliminates the grace period for that billing cycle. Interest will be charged not only on any unpaid balance from the previous month but also on the new purchases made during the current billing cycle. This significantly increases your overall debt and interest payments.

-

Cash Advances and Grace Periods: Cash advances, which are essentially loans taken directly from your credit line, typically do not have a grace period. Interest charges begin accruing immediately upon receiving the cash advance.

-

Balance Transfers and Grace Periods: Balance transfer offers often include a promotional period with a 0% APR. However, the existence of a grace period for purchases made during this promotional period can vary depending on the terms and conditions specified by the credit card issuer.

Closing Insights

Understanding and effectively utilizing your credit card grace period is a fundamental aspect of responsible credit management. Paying your balance in full before the due date not only avoids interest charges but also contributes to a healthy credit history. Failure to do so can lead to accumulating debt and negatively impacting your credit score. By consistently managing your credit card payments, you can minimize financial burdens and maintain a strong financial standing.

Exploring the Connection Between Credit Score and Grace Periods

A strong credit score is crucial for obtaining loans, mortgages, and even securing favorable insurance rates. While utilizing your grace period doesn't directly boost your credit score, consistently paying your balance in full demonstrates responsible credit behavior, which is a key factor in maintaining a good credit score. Conversely, repeatedly missing payments and incurring interest charges will negatively affect your credit score, potentially making it harder to obtain credit in the future.

Further Analysis of Credit Utilization

Credit utilization, which refers to the percentage of your available credit that you are using, is another significant factor influencing your credit score. Keeping your credit utilization low (ideally below 30%) signals responsible credit management. Paying your credit card balance in full each month before the due date keeps your credit utilization low, thus positively affecting your credit score.

| Credit Utilization | Impact on Credit Score |

|---|---|

| Below 30% | Positive impact |

| 30-50% | Moderate impact |

| Above 50% | Negative impact |

FAQ Section

Q1: What happens if I miss my due date by a day or two? While some issuers may offer a short grace period for late payments, most will immediately start charging interest on your outstanding balance.

Q2: Can my grace period change? Yes, the length of your grace period might vary based on your payment history and the credit card issuer's policies.

Q3: Does paying a portion of my balance affect my grace period? Paying only a portion of your balance will eliminate your grace period, resulting in interest charges on your remaining balance, including new purchases.

Q4: How can I track my grace period? Check your credit card statement for the due date, which marks the end of your grace period. Many credit card companies also offer online tools and mobile apps to monitor account activity and due dates.

Q5: What if my statement shows a different due date than usual? Contact your credit card issuer immediately to understand the reason for the change. This may indicate an error or a change in their policy that you need to be aware of.

Q6: Can I extend my grace period? Generally, you cannot extend your grace period once it's been established.

Practical Tips for Maximizing Your Grace Period

-

Understand your billing cycle: Know the exact date your billing cycle ends and when your payment is due.

-

Set reminders: Use calendar reminders or mobile apps to ensure timely payments.

-

Pay in full: Make it a habit to pay your credit card balance in full before the due date to fully benefit from the grace period.

-

Review your statement carefully: Check your statement for any errors or discrepancies and contact your credit card issuer immediately if needed.

-

Monitor your credit utilization: Keep your credit utilization low by paying your balance consistently.

-

Avoid cash advances: Remember cash advances generally don't have a grace period, so use them sparingly.

-

Automate payments: Set up automatic payments to ensure you never miss a due date.

-

Read your credit card agreement: Familiarize yourself with your credit card's terms and conditions, including the specific details of your grace period.

Final Conclusion

The credit card grace period is a valuable tool that can significantly impact your personal finances. By understanding how it works, its limitations, and the consequences of missing payments, you can take proactive steps to manage your credit responsibly. Consistent and timely payments, combined with mindful spending habits, are essential for maximizing the benefits of the grace period and maintaining a positive credit history. Proactive management of your credit cards will ultimately lead to better financial health and greater financial freedom. Continuously educating yourself about credit card mechanics will ensure you navigate the financial landscape with confidence and security.

Latest Posts

Latest Posts

-

Target Method Of Payment

Apr 02, 2025

-

Perkins Loans

Apr 02, 2025

-

Perkins Loan Definition

Apr 02, 2025

-

What Is The Minimum To Pay On A Credit Card

Apr 02, 2025

-

Why Do Credit Cards Have A Minimum Payment

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Is A Grace Period On A Credit Card Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.