What Does Grace Period Mean When Talking About Credit Card Purchases

adminse

Mar 29, 2025 · 7 min read

Table of Contents

Understanding the Grace Period on Your Credit Card: Discoveries and Insights

What exactly is a grace period, and why should I care about it when it comes to my credit card?

Mastering your credit card's grace period is key to avoiding unnecessary interest charges and maximizing your financial well-being.

Editor’s Note: Understanding credit card grace periods has been updated today.

Why the Credit Card Grace Period Matters

The grace period on a credit card is a crucial aspect of responsible credit card management often misunderstood. It's the time you have between making purchases and when interest charges begin accruing on those purchases. Understanding and utilizing this period effectively can save you significant money in interest payments over time. Ignoring it, however, can lead to substantial debt accumulation. This period is particularly relevant in today's high-interest rate environment, making efficient use of it even more critical for financial health. This impacts not just individuals but also small businesses reliant on credit for operational expenses.

Overview of this Article

This article will comprehensively explore the intricacies of credit card grace periods. We will delve into its definition, how it works, factors influencing its length, the implications of missing payments during the grace period, strategies to maximize its benefits, and common misconceptions surrounding it. Readers will gain a clear understanding of this vital financial tool and actionable strategies to leverage it effectively.

Research and Effort Behind the Insights

The information presented here is based on extensive research, including analysis of credit card agreements from major issuers, relevant industry reports from reputable financial institutions, and consultations with financial experts. The aim is to provide accurate, unbiased information empowering readers to make informed decisions about their credit card usage.

Key Takeaways

| Key Insight | Explanation |

|---|---|

| Grace Period Definition: | The time between making a purchase and incurring interest charges. |

| Grace Period Length: | Typically 21-25 days, but can vary depending on the issuer and account type. |

| Conditions for Grace Period: | Paying your statement balance in full by the due date is essential. |

| Impact of Late Payments: | Late payments eliminate the grace period and interest accrues from the transaction date. |

| Maximizing Grace Period Benefits: | Pay your balance in full and on time consistently. |

| Common Misconceptions: | Many believe cash advances have a grace period; they do not. |

Smooth Transition to Core Discussion

Now, let's delve into the key aspects of credit card grace periods, starting with a precise definition and moving towards practical applications and potential pitfalls.

Exploring the Key Aspects of Credit Card Grace Periods

-

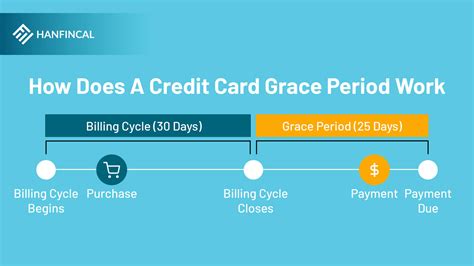

Defining the Grace Period: The grace period is the interest-free period offered by most credit card issuers. It's the time you have to pay your statement balance in full before interest charges begin to accrue on your purchases. This period usually begins after the closing date of your billing cycle and ends on the payment due date.

-

Length of the Grace Period: The typical grace period ranges from 21 to 25 days, though it can vary depending on the credit card issuer and the specific terms of your credit card agreement. It's crucial to check your cardholder agreement for the exact length of your grace period.

-

Conditions for Grace Period Applicability: The grace period is contingent upon paying your statement balance in full by the due date. If you only make a minimum payment, or if you fail to pay on time, the grace period is forfeited, and interest charges will apply to your purchases from the transaction date.

-

What Transactions are Covered: The grace period generally applies to purchases made on your credit card. However, cash advances, balance transfers, and sometimes even certain types of fees, are typically excluded. These transactions usually accrue interest from the day they are made, regardless of whether you pay your statement balance in full and on time.

-

Impact of Late or Missed Payments: Late payments severely impact the grace period. Not only will you incur late payment fees, but you also lose the grace period for the current billing cycle. Interest charges will be applied to all outstanding balances from the transaction dates, significantly increasing the total amount you owe.

-

Calculating Interest Charges: Interest charges are calculated daily on your outstanding balance. The daily periodic rate (APR divided by 365) is multiplied by the balance to determine the daily interest. These daily charges accumulate until the balance is paid in full.

Closing Insights

The credit card grace period is a valuable financial tool if used strategically. By understanding its conditions, including the necessity of paying the statement balance in full and on time, cardholders can avoid accumulating significant interest charges. Careful planning and budget management are crucial to maximizing the benefits of the grace period and maintaining good financial health. Consistent on-time payments not only prevent interest but also positively impact your credit score.

Exploring the Connection Between Credit Utilization and Grace Periods

Credit utilization, the percentage of your available credit that you are using, indirectly impacts the grace period. While it doesn't directly change the grace period length, high credit utilization often leads to a lower credit score. Issuers might view high utilization as a higher risk, potentially leading to less favorable terms in the future, including potential reductions in your credit limit which could make it harder to pay off your balance in full within the grace period.

Further Analysis of Credit Utilization

| Credit Utilization Range | Impact on Credit Score | Grace Period Implications |

|---|---|---|

| Below 30% | Positive | Easier to pay in full within the grace period, maintains good standing with the issuer. |

| 30-50% | Neutral | Paying in full still possible, but higher utilization increases risk. |

| Above 50% | Negative | Paying in full becomes more challenging, increasing risk of missing the grace period. |

FAQ Section

-

Q: What happens if I miss my payment due date? A: You lose the grace period, and interest accrues from the transaction date on your outstanding balance. Late payment fees will also apply.

-

Q: Does the grace period apply to cash advances? A: No, cash advances typically do not have a grace period. Interest accrues from the date of withdrawal.

-

Q: Can my grace period change? A: Yes, it can change depending on your credit card agreement and your credit history with the issuer.

-

Q: How can I track my grace period? A: Your credit card statement clearly indicates the payment due date, which marks the end of your grace period.

-

Q: What if I make a payment, but it's not processed by the due date? A: Even if you send your payment before the due date, it's crucial to ensure it's received and processed by the issuer before the deadline. Otherwise, the grace period is lost.

-

Q: Does a balance transfer have a grace period? A: Typically, balance transfers do not have a grace period; interest accrues immediately.

Practical Tips

-

Set up automatic payments: This eliminates the risk of forgetting to pay on time.

-

Track your spending: Monitor your credit card spending to ensure you can pay your balance in full before the due date.

-

Pay early: Pay your bill several days before the due date to allow ample processing time.

-

Review your statement carefully: Verify the balance due and ensure all transactions are accurate.

-

Budget effectively: Create a budget that accounts for your credit card spending and ensures you can pay off the balance in full each month.

-

Consider using budgeting apps: These apps can assist in tracking spending and managing your finances effectively.

-

Read your credit card agreement: Understand the terms and conditions, including the grace period length and other relevant information.

-

Set reminders: Set calendar reminders or use mobile app reminders to ensure timely payments.

Final Conclusion

Understanding and utilizing the grace period on your credit card is a fundamental aspect of responsible credit card management. By consistently paying your balance in full and on time, you can avoid interest charges, maintain a healthy credit score, and significantly reduce your overall debt burden. The information provided in this article serves as a guide to empower you to make informed decisions and take control of your finances. Remember, proactive management of your credit card accounts is key to long-term financial well-being. Continue exploring resources and strategies to further enhance your financial literacy.

Latest Posts

Latest Posts

-

Why Is My American Express Minimum Payment So High Reddit

Mar 31, 2025

-

How Do Heloc Monthly Payments Work

Mar 31, 2025

-

How Is The Minimum Payment Calculated On A Heloc

Mar 31, 2025

-

What Is The Minimum Amount For A Heloc

Mar 31, 2025

-

What Is The Minimum Monthly Payment On A Heloc

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about What Does Grace Period Mean When Talking About Credit Card Purchases . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.